Key market findings as of February 5, 2020

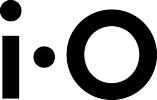

• Modern office stock in Bratislava stood at 1.84 million m2 by the end of Q4 2019

• The A class buildings represent 62%of the market share and B class buildings represent 38%

• In Q4 2019 there were 3 smaller office buildings delivered in Bratislava

• The overall vacancy rate amounted to 8.73%in the last quarter of 2019

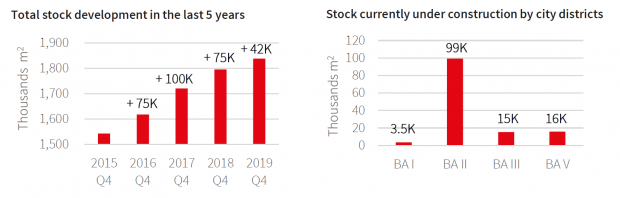

Stock and Supply

Currently approx. 1.84 million m2 of A and B grade office premises figure on the Bratislava market. Buildings with certification as green/sustainable – LEED or BREEAM ratings take 34% of the total stock – approx. 621,000 m2. The A-class buildings represent 62%of the market share and B class buildings represent 38%. There are currently 6 office buildings under construction to be completed during the year 2020, delivering almost 109,000 m2 of office space area to Bratislava market stock. In Q4 2019 3 new office buildings were completed in Bratislava: Bezručova (4,500 m2) and The Corner (1,170 m2) both in the city center and Blumenau (5,030 m2) in outer city (Bratislava IV). The most active areas in terms of construction in Bratislava are locations surrounding either Eurovea or Nivy where we expect new CBD to be created.

Demand

In Q4 2019, the total take up reached 62,000 m2 which compared to the previous quarter represents approximately 133% increase. The three largest transactions in the fourth quarter of 2019 were the following: Aupark Tower I – renegotiation (12,200 m2) followed by Digital park II & III – renegotiation (8,900 m2) and Sky Park Offices – pre-lease (5,500 m2). We registered 5 other transactions which exceeded size of 1,000m2. During the fourth quarter of 2019 majority of tenants came from sectors such as: IT (61%), followed by professional services (14%) and Pharma/Medical (5%). Renegotiations represented 57% of the total take-up. New leases represented 29%, 12% of all transactions were attributed to pre-leases and expansions secured 2%.

Vacancy

The overall vacancy rate in Bratislava has slightly decreased from 8.80% to 8.73% since the previous quarter. The lowest vacancy rates were recorded in Bratislava III (3.57%), followed by Bratislava I (6.38%) and Bratislava V (6.94%) together with Bratislava II (9.40%). The highest vacancy rate was recorded in Bratislava IV – 30.09% due to the recent delivery of not fully leased office premises in the area. Approximately 65% of all vacant space is located in Bratislava I & II, simply because these two districts are the ones with the largest stock volume. Additionally, 22% of all vacant office space is located in Bratislava IV, 4% in Bratislava district III and 9% in Bratislava V. Differences in vacancies between all districts are slowly fading. It shows that today’s tenants are not focused only on the CBD or City Centre like they were in the past.

Rental Levels

Prime headline rents are stable in the range of €13.50 - 17.0 m2/month. Inner-city rents are also stable: Bratislava I at €13.00 – 17.00 m2/month and Bratislava II and Bratislava V at €12.50 – 14.00 m2/month. Rents in the Outer City also remained at €8.00 – 11.00 m2/month. All of these numbers refer to prime levels achieved in a limited number of prime properties. Second-hand products stand at approximately €1.00 - 2.50 m2/month below the mentioned ranges. Standard incentives are currently being reconsidered by all landlords. 1 month rent free for each year of the lease signed is history or depending on the tenant's agent negotiation skills. Generally, the availability of incentives is linked to the current vacancy rate in the building and offer of other neighboring competing buildings.

Forecast

Year 2020 will be characterized by a strong delivery of new office buildings but also flex space growth. There are currently 6 buildings to be completed in 2020 delivering 109,000 m2 of new office space, which will most likely increase vacancy above the current sub 9% level. We are expecting Tower 5 (15,300 m2), EINPARK Offices (16,000 m2) and Nivy Tower (31,000 m2) to be next finished office building projects in Bratislava. Later during the year, major office developments will be represented by Sky Park Offices (30,000 m2) and Pradiareň 1900 (11,000 m2). This fact can add up on the possible shift from landlord to tenant market in the upcoming years. Another solid growth in demand will be driven by flex space operators in the upcoming future. We are experiencing strong interest of major developers in Bratislava to feature modular shared office concepts within their buildings focused on SME for flexible or short-time use. Emphasis is on strong branding and diversification by offering exclusive services, high-end interior design combined with modern architecture or historically unique buildings. Examples of such practices are Qubes by HB Reavis or Base by Penta Real Estate.

English

English Slovensky

Slovensky