Stock and Supply I Key Market Characteristics

Currently, there is over 2 million sqm of A+, A and B grade office premises figure on the Bratislava market. The A+ and A class buildings represent 55% of the market share and B class buildings represent 45%.

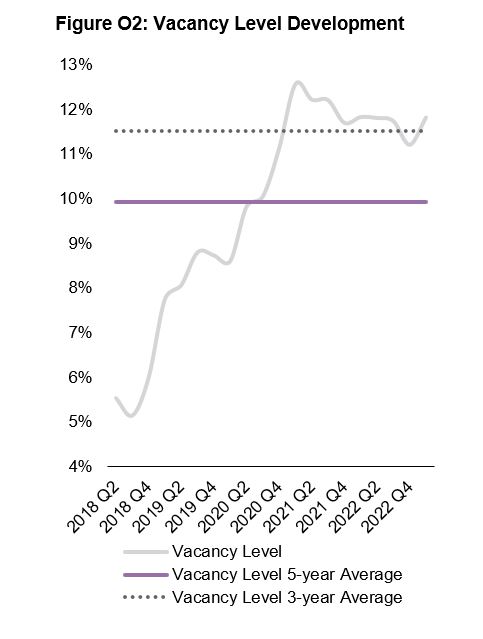

The overall vacancy rate in Bratislava has slightly increased from 11.21% to 11.82% compared to the previous quarter.

In the first quarter of 2023, two buildings were completed: Nido (3,400 sqm) and New Apollo (48,000 sqm).

Currently, there are 3 office buildings under construction planned to be completed by the end of 2023, delivering 63,000 sqm of office space area to Bratislava market stock. The most active areas in terms of construction in Bratislava are locations surrounding either Eurovea or Nivy where we expect new CBD to be created.

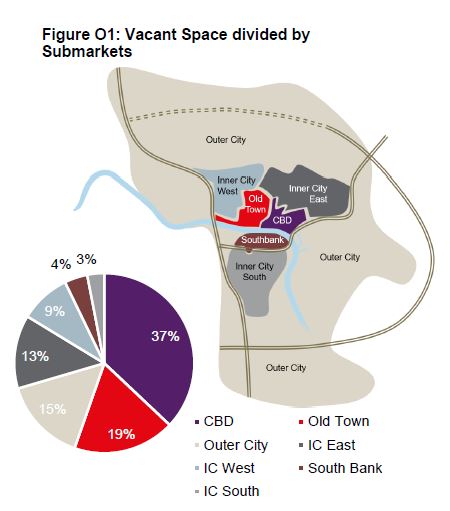

Vacancy

The overall vacancy rate in Bratislava has increased from 11.21% to 11.82% since the previous quarter.

The lowest levels of choice were recorded in South Bank (6.15%) followed by Inner City East (8.94%), Old Town (9.16%), Inner City South (13.55%) and CBD (13.69%). The highest levels of vacancy are in Outer City (16.37%) and Inner City West (19.87%).

The average vacancy rate for the last 3 years is at the level of 11.52%.

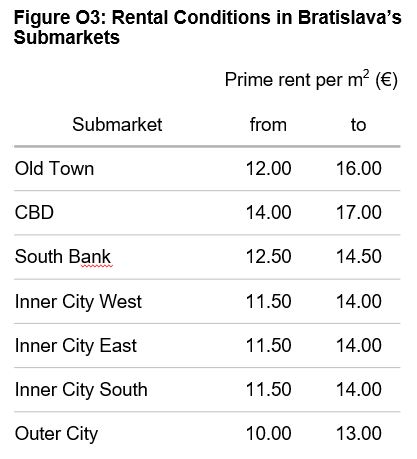

Rent

Prime headline rents are slightly increasing, and they are in the range of 14.00 -17.00 €/m2/month. Service charges have dramatically increased up to around 5.00 €/m2/month or even more, depending on the building grade.

Standard incentives are currently being reconsidered by all landlords. However, one month rent free for each year of the signed lease remains to be a relevant figure. Additionally, tenants with significant size and brand name have potential to negotiate financial contribution covering nearly full fit-out standard from numerous landlords. The outcome depends on tenant’s prosperity and agent’s negotiation skills. Generally, availability of incentives is linked to the building’s vacancy and other offers available in the neighbourhood.

Demand

In Q1 2023, the total take-up reached over 45,000 m2. The three largest transactions in the first quarter of 2023 were the following: a new lease (7,740 m2) followed by another new lease (5,000 m2) and a renegotiation (3,060 m2).

During the first quarter of 2023, the majority of tenants came from sectors such as:

Public/Embassy/Diplomatic Sector (28%), Professional services (21%), followed by IT Sector (18%) and Finance/Banking /Insurance Sector (10%).

New leases represented over 63% of all transactions, almost 21% were renegotiations, 14% were attributed to pre-leases and expansions represented less ca. 2%.

Forecast for H2 2023

We do not expect dramatic increase of market performance in the second half of 2023 mostly due to persistent economic uncertainty, increased costs and growth of inflation.

There will be fewer options of available premises in brand new A+ office developments. Additionally, office pipeline is significantly limited for the period 2023 - 2025. Brand new office projects with GLA over 10,000 m2 are expected to be delivered not earlier than in 2026.

Moreover, tenants will pay close attention to identify all cost saving elements of their current lease before relocating to new office space. The topic about rent indexation and postponing indexation have never been so demanded by tenants as it is now. These factors together with expensive fit-out costs have a negative impact on the demand for new offices.

Tenants no longer see COVID-19 as a major threat after experimenting with various hybrid work models. An increased number of people working from home, logically, created strong pressure to downsize traditional offices across all industries and reorganize current workspace.

Lastly, we see an ongoing trend in demand for office buildings with modern architecture, latest technology and green certification. Older buildings which are not kept up to date can be considered for re-development into residential buildings.

English

English Slovensky

Slovensky